One: International Paper and Georgia Pacific just raised prices on containerboard. Forget about all government data for a second. Why would the two companies involved in every shipment made around the world increase prices? Because demand is there.

Two: Consensus among analysts for S&P earnings for 2011 is $94. With the S&P near 1050 that puts us barely above a multiple of 11 times earnings with the historical average somewhere near 15.

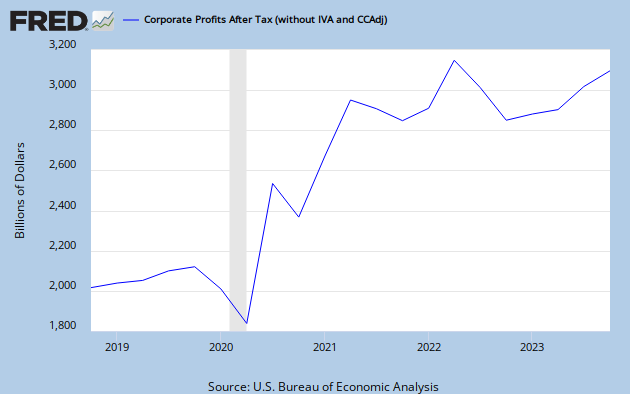

Three: We are still in the middle of an inventory rebuild after the Great Liquidation that wiped out all inventories in 2009. And corporate profits are still near all-time highs, in part due to the enormously slack labor market created by 10% unemployment. In fact, corporate profits at their highest levels ever:

Four: Consumer spending won’t slow, even with 10% unemployment. We’ve added jobs to the work force for the past 5 months in a row. And even though last month’s job increase was only 41,000 (not including the almost 400,000 in census hiring), average pay was up enough so that it was the equivalent of an extra 315,000 jobs if pay had stayed flat. This is more than enough to keep personal consumption expenditure at an all-time high, where it currently is. Follow the link...

http://blogs.wsj.com/financial-adviser/2010/07/01/seven-reasons-the-sp-500-is-going-to-1500/

No comments:

Post a Comment